Mastering Small Business Accounting Challenges

As a small business owner, you're likely juggling multiple roles – from marketing and recruiting to fostering customer relationships. However, among these varied duties lies the crucial responsibility of managing your finances and accounting.

While accounting might not be the highlight of your day, it's a vital aspect of your business's success. It serves as the financial language that reveals the true profitability and growth potential of your business.

Effective accounting isn't just about passion; it's about keeping your financial records in order and understanding the story they tell.

Table of Contents

- Introduction

- Cash Flow Management

- Dealing with Unexpected Expenses

- Finance Reporting

- Navigating Tax Filing

- Managing Payroll Effectively

- Managing Expenses Efficiently

- Mastering Financial Analysis

- Prioritizing Data Security

- DIY Accounting

- Modern Accounting Solutions

- Working Remotely

- Conclusion

#1. Introduction

Accounting typically involves the meticulous tasks of recording, summarizing, and analyzing your business's financial transactions. These steps are essential for understanding your financial health and making informed decisions. However, small business accounting isn't without its challenges. It's not just the complexity of the tasks but also navigating through various financial hurdles that can seem difficult at times or overwhelming.

In this blog post, we'll explore effective strategies to overcome common accounting challenges faced by small businesses. From simplifying record-keeping to understanding financial reports, we'll provide insights to help you turn accounting from a chore into a valuable tool for your business's growth and success.

Discover the key accounting challenges that small businesses encounter, and learn proven strategies for overcoming them

#2. Cash Flow Management

Cash flow management can pose a significant challenge for small businesses. Cash flow is critical because it's the lifeblood of your business. Small business owners often grapple with the task of allocating funds to cover ongoing expenses and keep their businesses afloat.

"According to a study performed by Jessie Hagen of U. S. Bank, 82 percent of businesses fail because of poor management of cash flow"

To effectively manage your cash flow, it's essential to adopt a systematic approach.

- Begin by meticulously reviewing your bills and ensuring that you follow up promptly on outstanding customer payments.

- Keep a close eye on your monthly expenses and look for opportunities to reduce costs wherever feasible.

- Additionally, consider selling any unused equipment as a quick means of generating much-needed cash for your business.

By implementing these strategies, you can better navigate the challenges associated with cash flow management and ensure the financial health of your small business.

#3. Dealing with Unexpected Expenses

Imagine your company generates a yearly income of $150,000 after covering all expenses. At first glance, it might appear to be in a stable position. However, the real challenge emerges when unforeseen expenses or emergencies arise.

For instance, consider a scenario where one of your employees has an accident at work, and your insurance coverage falls short. The resulting medical bills and potential legal actions could potentially burden your business with many costs exceeding $1 million.

Even smaller unexpected expenses, such as a one-time government tax imposed on businesses in your area or a sudden increase in the cost of goods, can have a significant impact on your financial "bottom line".

If COGS increases without an increase in sales revenue, then the gross profit margin decreases. This means that your business will have less money to cover other expenses such as operating costs or debt payments. Another impact of high COGS on your company's bottom line is reduced net income

To address these challenges, it's crucial to optimize your current credit resources for managing short-term expenses effectively. Additionally, keep a vigilant eye on your long-term profitability to ensure that shifts in costs don't jeopardize your overall financial stability and liquidity.

#4. Finance Reporting

Among the most significant challenges faced by businesses is the task of adhering to the financial disclosure regulations set by the U.S. Securities and Exchange Commission. Keeping pace with these reporting requirements and accurately documenting financial information in preparation for potential audits can be quite demanding.

The optimal approach to guarantee compliance with reporting obligations is to delegate some of the workload. Consider enlisting the expertise of a specialized bookkeeper or accountant experienced in working with small businesses. Their proficiency will help ensure that your financial records remain current and in line with regulatory standards, alleviating the burden of reporting and enhancing the accuracy of your financial documentation.

The Securities and Exchange Commission (SEC) requires public companies, certain company insiders, and broker-dealers to file periodic financial statements and other disclosures.

#5. Navigating Tax Filing

Taxes are an inevitable part of running any business in the United States. However, the key to managing your tax liability effectively lies in making the most of deductions, which can significantly lower your tax bill when the filing deadline approaches. This is especially crucial for home-based small businesses.

One valuable tax provision to consider is Section 179 of the IRS tax code, which permits you to deduct the depreciation cost of business property immediately. By doing so, you can reinvest the money saved back into your company, bolstering your profits and ensuring that your business remains financially resilient.

Section 179 of the IRC allows businesses to take an immediate deduction for business expenses related to depreciable assets such as equipment, vehicles, and software. This allows businesses to lower their current-year tax liability rather than capitalizing an asset and depreciating it over time in future tax years. Reference

Staying on top of tax regulations can be challenging due to their constant evolution. Tax code and policy changes can have a significant impact on your small business, potentially leading to overpayment at year-end.

To navigate this, consider working with a qualified CPA. CPAs are tax law experts who can provide guidance on leveraging tax laws to your advantage, ensuring compliance with the latest regulations, and optimizing your tax position

#6. Managing Payroll Effectively

Taking on the responsibilities of an HR or payroll specialist can be a complex endeavor. Payroll management involves various aspects, such as accurate tax filing, ensuring timely and precise employee payments, meticulous tracking of employee time off, and addressing compliance matters.

To navigate these challenges, it's essential to consider outsourcing payroll or seeking the expertise of professionals who specialize in payroll management. This approach ensures that you avoid costly errors, maintain compliance, and ensure your employees are paid accurately and on time, allowing you to focus on other core aspects of your business.

Many accountants and bookkeepers are well-versed in the intricacies of managing payroll. They not only bring their expertise but can also leverage top-rated payroll software and online tools to streamline the process further. This combination of human expertise and advanced technology ensures efficient and accurate payroll management for your business.

#7. Managing Expenses Efficiently

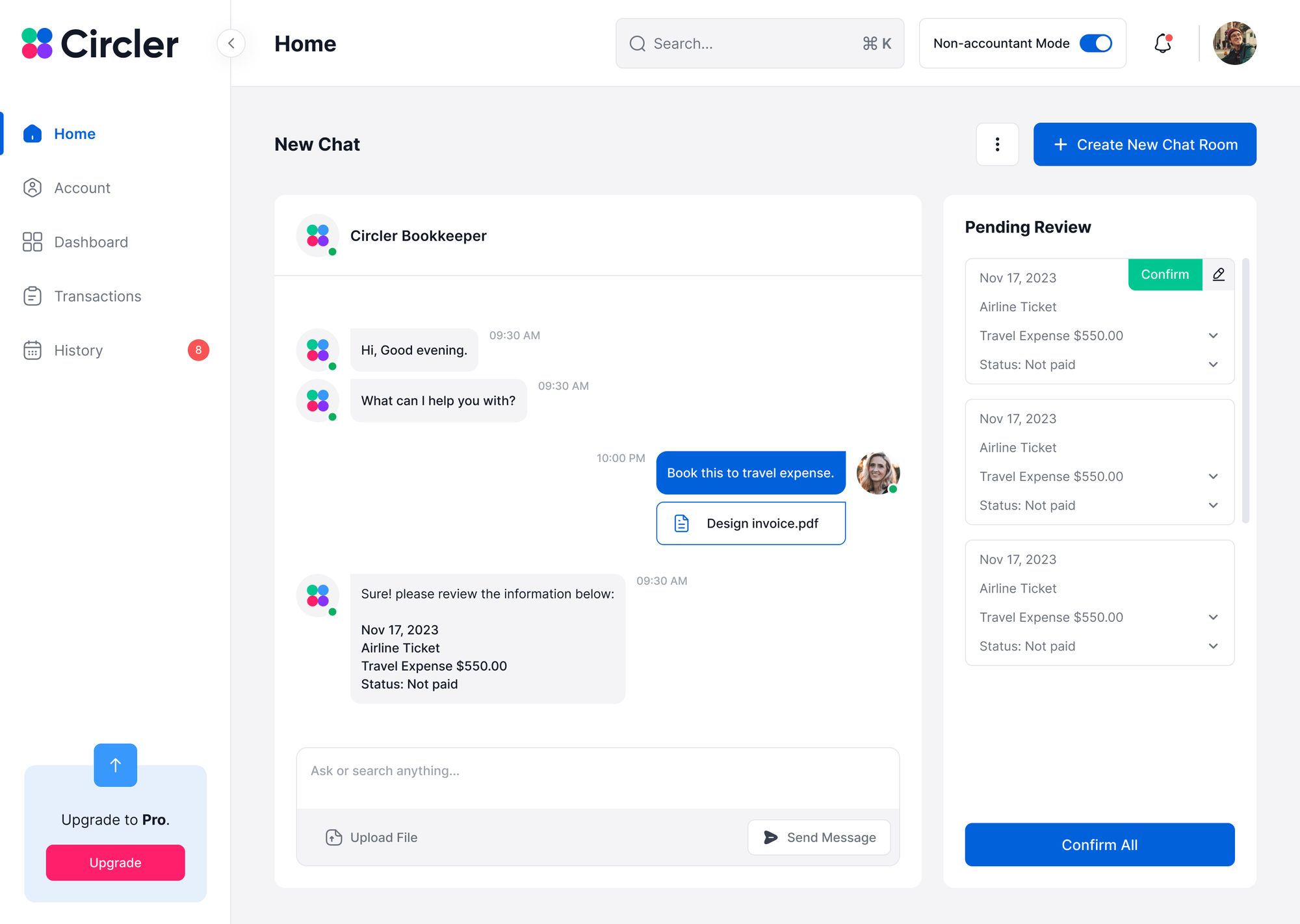

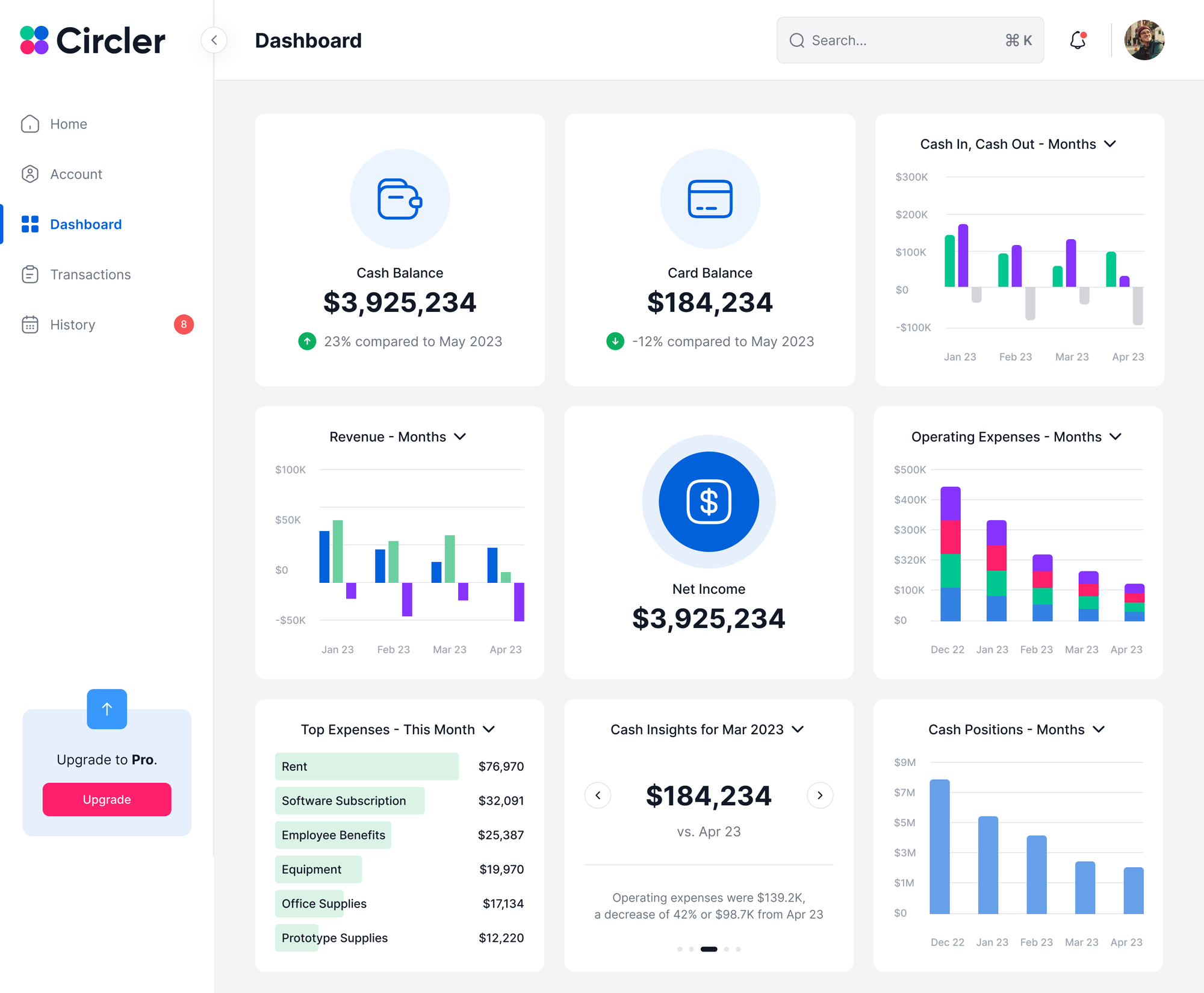

Maintaining records of receipts and recurring expenses can pose a significant challenge, yet it's crucial to remain competitive in the market. That's where Circler.io comes in.

Circler.io is an AI-powered bookkeeping solution that processes user prompts to transform receipts into well-organized journal entries. Additionally, it offers real-time insights on expenses and incomes for enhanced financial management. With Circler.io, you no longer need to rely on paper receipts stored in filing cabinets for later processing. It's a modern solution that simplifies expense tracking and financial insights, tailored to meet your company's specific needs.

#8. Mastering Financial Analysis

Reconciling your books can be a tedious task, especially without the aid of accounting software, as errors can lead to inaccurate data.

To ensure financial accuracy, it's crucial to regularly verify all your business transactions. This can be done on a monthly, weekly, or even daily basis. Consider making it a daily habit to review your accounting books while transactions are still fresh in your memory.

Effective financial decision-making involves a three-step process: interpretation, analysis, and guidance. Merely generating numbers is the initial step. The real challenge lies in understanding the meaning behind those numbers and, more importantly, devising strategies to enhance them.

Circler.io has made interpreting accounting accessible to business owners with no accounting background.

#9. Prioritizing Data Security

Every time you increase your business’s online exposure, you increase its risk of getting targeted by hackers. That’s why companies of all sizes must start taking cybersecurity seriously.

To get started, you should assess your business’s level of vulnerability. You might consider working with a cybersecurity professional who can evaluate your business and identify areas of weakness. From there, you can come up with a plan to address them.

Cyber insurance is one option that can help protect your business against losses resulting from a cyber attack Reference

#10. DIY Accounting

When it comes to your business's accounting, attempting a do-it-yourself approach can lead to costly errors. While you may excel in your business, expertise in bookkeeping is a separate skill set.

Even if you manage to balance your books, the potential for avoidable mistakes looms large. Unintentionally overlooked invoices, cash flow challenges, and tax overpayments are all risks.

Opting to hire a skilled accountant offers multiple benefits. They ensure your financial records remain current and error-free. Having a second set of eyes on your books reduces the likelihood of mistakes and helps identify cost-saving opportunities. However, it's important to note that hiring an accountant or bookkeeper can be an added expense for your business, so it's essential to weigh the benefits against the cost. The time saved and the potential for improved financial management can often justify the investment.

#11. Modern Accounting Solutions

While Excel spreadsheets have long been a go-to method for small business owners to manage their finances, the question arises: "Why change now if it's been working for years?"

The answer lies in the transformative capabilities of cloud-based accounting software. It streamlines business processes, identifies growth opportunities, and significantly reduces the time required for transaction recording and reconciliation.

Most cloud-based accounting programs operate on a monthly subscription model, offering a wide range of services such as sales tracking, budget planning, inventory management, financial reporting, payroll processing, and tax management. The wealth of features may seem overwhelming, but these software solutions are incredibly powerful and provide actionable insights into your company's financial health.

By familiarizing yourself with the software and training your staff to use it effectively, you can significantly cut down the time required for generating essential reports.

Notably, Circler.io is one such platform that exemplifies the benefits of modern accounting software.

#12. Working Remotely

The pandemic compelled a significant shift to remote work, and even now, many employees prefer not to return to the office full-time. However, this transition to remote work has introduced tax compliance challenges for businesses.

As reported by the Society for Human Resource Management, 28% of employees have worked outside their home state or country during this period, with only a third informing their employers. This discrepancy can lead to businesses neglecting payroll tax withholding, potentially resulting in substantial issues during audits.

To address this, it's crucial to consider implementing a new remote work policy for your employees. Additionally, explore methods to track your employees' work locations to ensure compliance with tax requirements, safeguarding your business from potential tax-related risks.

Conclusion

In closing, effective accounting practices are the foundation of a financially sound and successful business. Recording, categorizing, auditing, and reporting on every transaction are essential steps to ensure accuracy and provide a clear financial picture.

The modern landscape of accounting has been revolutionized by advanced solutions like Circler.io.

Circler.io is a bookkeeping AI, that simplifies financial management by handling purchases, expenses, sales revenue, invoices, and payments. It converts and records financial data into general ledgers, facilitating the creation of essential financial statements like balance sheets and income statements.

As you navigate the challenges of accounting, remember that a well-organized financial system not only helps you identify errors but also empowers you to make informed decisions that drive your company's growth and financial stability. By embracing modern tools like Circler.io, you can simplify your financial management and position your business for success in the ever-evolving world of accounting.