Do you need a CPA for Your Small Business?

As a business owner, you might wonder if you need a Certified Public Accountant (CPA). It's not always necessary to hire a CPA for your small business, but it can be really helpful, especially when it's time to do your taxes. A CPA, with their expertise in taxes, can navigate the complexities of tax laws to potentially save your business money. Additionally, many CPAs offer financial advisory services, assisting in the creation of comprehensive financial plans to achieve your personal financial goals.

Table of Contents

#1. Overview

In our blog, we address a common concern for small business owners: the complexities of tax implications, accounting, and financial obligations. Juggling these tasks alone often leads to inefficiency and disorder. That's why many businesses turn to a Certified Public Accountant (CPA) for expert handling of these crucial aspects. We explore what a CPA is, the benefits of hiring one, and compare their role with other financial professionals. Plus, we delve into how efficient bookkeeping supports CPAs in managing your company's taxes, ultimately guiding you to decide if a CPA is right for your business. This guide is tailored to help you navigate these decisions with confidence

#2. What Is a CPA?

A Certified Public Accountant (CPA) is a professional in accounting who has passed the CPA examination and met additional state certification and experience requirements. Licensed by state boards of accountancy, CPAs are recognized for their expertise in accounting, tax, and financial services. They offer a range of services, including tax preparation and planning, auditing, financial reporting, business advisory, and personal financial planning.

CPAs are also pivotal in managing a company’s finances, taxes, and investments in compliance with tax laws. Furthermore, in the event of an IRS audit, a CPA can represent and guide a business throughout the process, leveraging their deep understanding of tax laws and audit procedures. This credential represents a high standard of education, experience, and ethical commitment, making CPAs invaluable professionals for both personal and business financial needs.

#3. Why You Should Consider Hiring a CPA?

Hiring a Certified Public Accountant, or CPA, is a wise decision for your business. CPAs are skilled experts with extensive training and experience. Here’s why prioritizing a CPA can significantly benefit your business:

- Bookkeeping: Engaging a CPA for bookkeeping can turn your business's financial management into a strategic asset. CPAs bring precision, expert financial analysis, and strategic financial advice for cost management and growth. They ensure tax-compliant records, reducing errors and saving valuable time. It is important to note that while accountants and bookkeepers can manage financial records, CPAs are qualified to elevate this function with higher-level analysis and strategic guidance.

- Tax Planning: CPAs navigate complex tax laws with ease, ensuring that businesses do not overpay due to misunderstandings or errors. Tax planning under a CPA's guidance ensures compliance and efficiency in tax filings.

- Tax Return Preparation: A CPA's deep knowledge of tax regulations allows businesses to take full advantage of deductions and credits, which can substantially lower tax liabilities. Their accuracy reduces the risk of audits and, if an IRS audit occurs, a CPA is qualified to represent and defend your business effectively.

- Financial Consulting: Beyond accounting, CPAs advise on business structure and financial planning. Their insights into growth strategies help minimize risks and enhance profits.

- Understanding Other Financial Professionals:

- Accountants manage day-to-day financial records and prepare statements but typically do not represent clients in IRS audits.

- Enrolled Agents (EAs) are tax-focused experts federally licensed to represent taxpayers before the IRS. They are ideal for detailed tax filing assistance.

- Bookkeepers are critical for daily transaction management, ensuring that records are accurate and up-to-date. They are the backbone of a business's financial record-keeping, laying the groundwork for accountants and CPAs to perform more complex tasks.

When deciding on the financial management of your business, it's essential to choose the right expert. While CPAs, accountants, and bookkeepers each play unique roles, it's important to note that these roles can overlap. An accountant or bookkeeper might also be a CPA, combining detailed day-to-day financial management with the strategic expertise of a CPA. This blend of skills can offer comprehensive support for both the everyday financial tasks and the broader strategic financial planning essential for your business's growth. In the end, understanding the distinct qualifications and services of each professional will help you make an informed decision that best suits your business's needs

#4. How Can Efficient Bookkeeping Assist Your CPA in Managing Company Taxes?

As a business owner, you play a pivotal role in facilitating your CPA’s work, especially during tax season. One key area where you can significantly aid your CPA is through efficient bookkeeping. Here’s how you can make their job easier and more effective:

- Maintain Accurate and Up-to-date Records: Ensure that all your financial transactions are recorded accurately and kept up-to-date. This includes sales, expenses, payroll, and any other financial transactions.

- Organize Financial Documents: Keep all your receipts, invoices, bank statements, and financial documents well-organized. This makes it easier for your CPA to access and review necessary information.

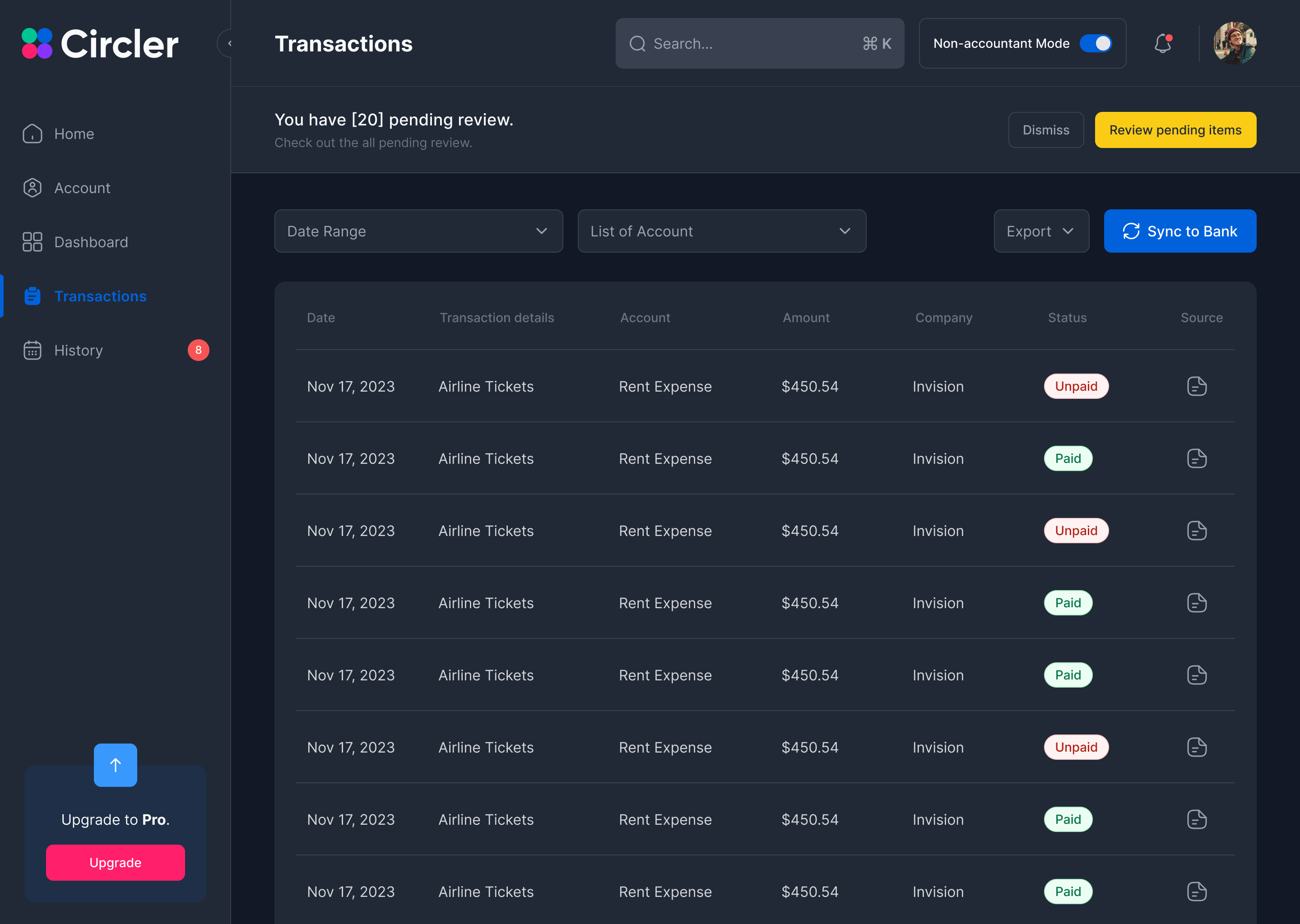

- Use Efficient Bookkeeping Tools: Leverage modern bookkeeping tools like Circler.io, a Bookkeeping AI, to streamline your financial record-keeping. Circler.io can accurately log your financial transactions, reducing the likelihood of errors and ensuring that records are always current with minimum human oversight. Additionally, considering that CPAs may charge by the hour or per transaction for bookkeeping in addition to tax return filing, using Circler.io can be a cost-effective way to maintain your books. You can then download your accounting records from Circler and send them to your CPA for tax purposes, potentially saving money.

See the below image to see a list of transactions, categorized accurately by Circler

- Categorize Transactions Appropriately: Use your bookkeeping software to categorize transactions correctly. This not only keeps your finances organized but also simplifies the task of identifying deductible expenses.

- Reconcile Bank Statements Regularly: Regular reconciliation of your bank statements with your bookkeeping records ensures that your financial data is consistent and reliable.

- Prepare a Summary of Major Transactions: Provide your CPA with a summary of significant transactions, especially large expenditures or income, which might have substantial tax implications.

- CPAsBe Proactive in Communication: Keep an open line of communication with your CPA. Inform them of any significant changes in your business that might affect your taxes,

By maintaining efficient and accurate bookkeeping, you not only ease the workload for your CPA but also contribute to more effective tax planning and filing. Tools like Circler.io enhance this process by providing real-time financial insights, reducing manual data entry, and ensuring that your financial records are comprehensive and readily accessible for your CPA. This collaboration between efficient bookkeeping practices and your CPA’s expertise can lead to better financial health and tax savings for your business.

Bottom Line: "Do You Need a CPA for Your Small Business?"

Yes, most businesses can significantly benefit from the services of a CPA. While their expertise is invaluable, it's important to recognize that hiring a CPA for accounting and bookkeeping tasks can be expensive. This is where utilizing tools like Circler.io becomes a cost-effective solution. Circler.io efficiently handles bookkeeping, storing all transactions digitally, which simplifies the reconciliation process. It also allows for easy exportation of financial records, making it convenient to provide your CPA with accurate and comprehensive data for tax and financial planning.

Although a CPA's expertise is not a legal requirement except in specific situations like audits, their knowledge in crafting efficient tax strategies is invaluable for any business. Furthermore, a CPA who also acts as a financial advisor can offer additional benefits. They can manage your personal finances and integrate them with your business finances, aligning your overall financial plans. This dual role makes a CPA an essential partner for both your business's success and your personal financial health. By combining the strengths of a CPA with the efficiency and cost-effectiveness of modern bookkeeping tools like Circler.io, you can ensure a robust financial foundation for your business.