Understanding Small Business: The SBA Definition

Small businesses are the backbone of the economy, offering diversity and flexibility in a market often dominated by large corporations. Understanding the different types of small businesses is crucial for anyone looking to start their own venture or expand their knowledge of the business world. This article aims to provide a comprehensive overview of the various forms of small businesses, their unique characteristics, and how they operate within the broader economic landscape. We'll explore the legal structures, the size and scope of operations, and the roles these businesses play in their communities and industries.

Table of Contents

- 1. Understand the SBA's Criteria for Defining Small Businesses in the U.S.

- 2. Understand the Legal Structures of Small Businesses

- 3. Understand the Small Business Size Standards, by Industry

- 4. Understand the Importance of the SBA’s Business Size Definition

- 5. Understand Why Most Businesses Qualify as "Small" in the U.S.

- 6. Understanding Who Small Business Owners Are

- 7. Understand Small Business Pros and Cons

- 8. Conclusion

- 9. Understand Why Circler.io is a Great Bookkeeping Tool for Small Businesses

1. Understand the SBA's Criteria for Defining Small Businesses in the U.S.

In the United States, a small business is typically a company that is smaller in size, especially when compared to larger companies. This means they usually have fewer people working for them and don't make as much money each year.

The Small Business Administration (SBA), a government agency, gives more specific details about what counts as a small business. According to the SBA Regulations, a small business is one that:

- Meets certain rules about the number of people it employs or how much money it makes in a year. These rules can be different depending on what kind of business it is. See industry-specific standards.

- Aims to make a profit or Operates with a profit-making motive.

- Has its main operations in the United States, works mostly within the U.S., or contributes a lot to the U.S. economy.

- It is owned and run independently and does not hold a dominant position in its field on a national level.

2. Understand the Legal Structures of Small Businesses

A small business can be set up in different legal ways, like being owned by just one person (sole proprietorship), by a group of people (partnership), or as a corporation.

What is a sole proprietor?

A sole proprietor is a person who runs an unincorporated business with a single owner. No legal distinction is made between you and the business. That means you are personally responsible for all aspects of the venture, including business debts, losses, and liabilities. If someone makes a legal claim against a sole proprietorship, they can potentially go after both business assets and the owner’s personal assets.

In other words, a sole proprietor has unlimited personal liability.

Unlike other types of business structures—like LLCs, S corps, or C corps—you don’t have to file any paperwork or pay any fees to establish a sole proprietorship. In fact, any new business with one owner is considered a sole proprietorship automatically. For example, if you do freelance work outside of your normal job where you are a full-time employee, that work is done under a sole proprietorship if you haven’t set up any other type of business entity.

Key Advantages of proprietorship:

- Lower taxes. With a sole proprietorship, you only have to do your taxes once, whereas an LLC requires you to file state and federal taxes separately. The company doesn’t file taxes, but the owner does.

- Complete control of your business. Because you don’t have any partners or investors to consider, you get to make every business decision the way you want.

- Easy to change your structure in the future. If you start out with a sole proprietorship, you’re not stuck with that company structure. You can change to a different type of business at a future date, whenever you're ready.

What is a partnership?

A partnership is a business structure co-owned by two or more individuals, known as partners. These partners contribute to the business in various forms, such as capital, property, labor, or skills, and share in the profits.

There are primarily two kinds of partnerships:

- General Partnership (GP): In a general partnership, the business is either equally owned by all partners or divided into agreed-upon percentages.

- Limited Partnership (LP): This structure allows for limiting both the control and liability of certain partners. In a limited liability partnership, while partners are personally liable, it is typically to the extent of their own actions or negligence.

Partnerships operate on a pass-through taxation system. This means that the partners, not the business entity, are taxed individually. Taxes are levied based on each partner's share of income from the business.

Key Advantages of Partnerships:

- Shared Responsibility: Partnerships embody the concept of "strength in numbers." Responsibilities, risks, and capital are shared among partners, reducing the burden on any single individual.

- Ease of Formation and Management: Starting a partnership is generally simpler compared to other business structures. It also often involves less paperwork and fewer tax filings, making ongoing management more straightforward.

Partnerships, with their shared responsibilities and simplified structure, offer an appealing option for those looking to collaborate and pool resources in a business venture.

Corporation

A corporation stands as a distinct legal entity, separate from its owners, ensuring that personal liability is largely removed from the equation. In this structure, the corporation itself shoulders the risks and responsibilities, safeguarding the personal assets of those who own and operate it. This separation is one of the key benefits of choosing a corporate structure.

Ownership transfer in a corporation is more straightforward compared to other business forms. However, corporations must adhere to specific requirements set by state jurisdictions, including the obligation to pay local, state, and federal taxes. These taxes are filed separately from the personal taxes of shareholders.

The tax implications for a corporation can vary by state. Corporations may sometimes have a tax advantage over individual tax rates, as seen in sole proprietorships, LLCs, and partnerships. But this is not a hard and fast rule and varies from case to case. Consulting a tax professional is advisable to navigate these complexities.

Corporations come in different types, each with its unique tax structure. For example, C corporations are subject to income tax, and their shareholders also pay taxes on dividends as personal income. Conversely, S corporations are exempt from corporate income tax. Understanding these distinctions is crucial for any business considering this structure.

Key Advantages of a Corporation:

- Reduced Personal Risk: Shareholders’ personal properties are protected. For instance, in litigation against the corporation, shareholders' personal assets are not at risk to cover liabilities.

- Ability to Raise Capital: Corporations can issue shares to raise capital. This aspect not only aids in funding but also can attract employees, offering a sense of stability and potential for compensation through shares.

Corporations, with their ability to mitigate personal risk and raise capital efficiently, offer a robust structure for businesses looking for growth, stability, and a clear separation between the owners and the business entity.

3. Understand the Small Business Size Standards, by Industry

Understanding the size standards for small businesses as defined by the U.S. Small Business Administration (SBA) is crucial, especially when considering eligibility for various federal government programs. The SBA's definition of a small business varies significantly across different industries, based on specific size standards.

See Small Business Size Regulations

These standards are primarily determined by two factors: the business's total revenue and the number of employees. The range for these criteria is quite broad. For instance, the maximum revenue for a small business can vary from $2.25 million to over $47 million, depending on the industry. Similarly, the employee count that qualifies a business as 'small' ranges from 100 to more than 1,500.

To ascertain if your business falls under the 'small' category, you need to refer to the North American Industry Classification System (NAICS) codes. The SBA uses these codes to classify industries.

Each industry, as defined by its NAICS code, has an associated size standard. These specifics can be found in the SBA’s Table of Size Standards. By consulting this table and knowing your industry's NAICS code, you can accurately determine if your business qualifies as a small business under the SBA's guidelines.

In the SBA’s Table of Size Standards, you’ll find business size standards for each NAICS industry code.

This classification is vital for small business owners seeking to participate in federal government programs tailored to assist small businesses, including loans, grants, and contracts.

4. Understand the Importance of the SBA’s Business Size Definition

The definition of a small business by the Small Business Administration (SBA) plays a crucial role. It not only safeguards small businesses in the broader economy, allowing them to effectively compete with larger companies but also assists entrepreneurs in accessing business grants, SBA loans, and valuable government contracts

5. Understand Why Most Businesses Qualify as 'Small' in the U.S.

Small businesses are also the largest category of businesses by size. As of 2023, there were more than 33 million small businesses in the US, employing almost half of the private sector.

Remarkably, according to the SBA's standards, 99.9% of all businesses in the U.S. fall into the small business category.

Businesses with less than 20 employees make up 5.4 million of these small businesses, and approximately 27 million are sole proprietorships, where the business owner is the sole employee. (SBA, 2022)

6. Understanding Who Small Business Owners Are

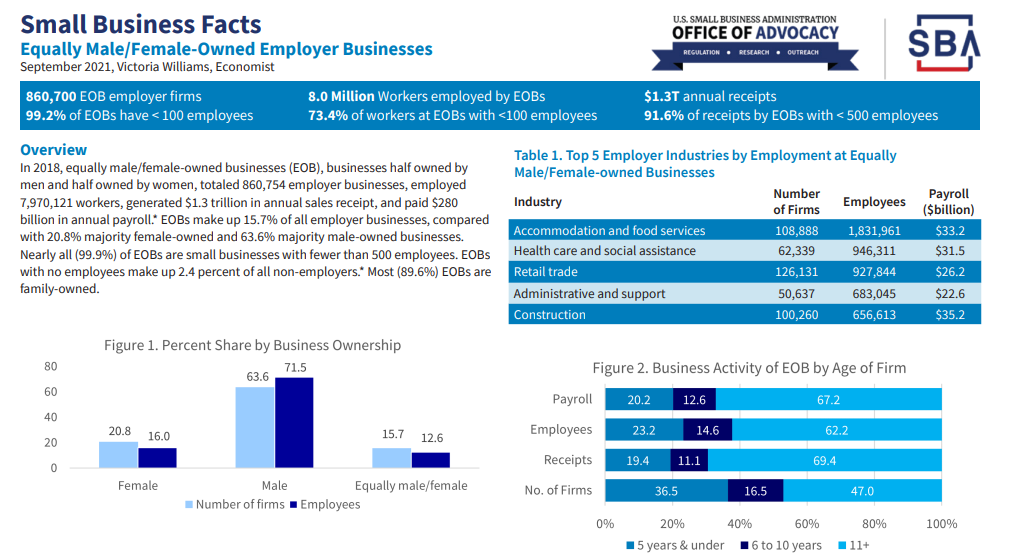

According to the SBA, small business owners are primarily men (63.8%). Women own 20.8% of small businesses, and the remaining 15.7% are equally owned by men and women partnerships.

Data collected from 20,000 small business owners shows that women-owned businesses are equally as successful as men-owned businesses across all independent measures of business success, including business starts, revenue growth, job creation, and number of years in business

Women are more likely to run service-based businesses, whereas men own more product or technology-based ventures.

7. Understand Small Business Pros and Cons

Generally, a small business has different operational issues than a major corporation. Here are some Small business benefits and disadvantages:

Pros of small businesses

- Small businesses can quickly adapt to market changes and customer needs, thanks to their size and streamlined decision-making processes.

- They typically have fewer layers of bureaucracy compared to larger companies, allowing for faster response times and greater operational efficiency.

- Small businesses often can dedicate more time to individual customers and build deeper relationships in industry collaborations.

Cons of small businesses

- Small businesses often need help to borrow money.

- They often struggle to compete with the pricing and marketing power of larger companies.

- Many small businesses are confined to local or regional markets, limiting their reach and growth potential.

8. Conclusion

Other considerations in defining a small business

While the Small Business Administration's (SBA) definition is a standard, there are other perspectives on what constitutes a "small" business:

- Employee Count and Operational Scale. A home-based business could be seen as a small or micro-business, while a company with the same profits but multiple employees and locations might not.

- Business Location: The place of operation also plays a role. A home-based business typically signifies a smaller operation compared to one with dedicated office space.

- Legal Structure Impact: The legal formation of a business can influence its perceived size. Corporations are often considered larger entities, while sole proprietorships and partnerships are usually associated with smaller businesses.

Takeaways.

- The legal definition of a small business varies by industry.

- The US Small Business Administration uses industry size standards to define businesses as “small.”

- Industry size standards are based on the number of employees or annual receipts, and determine eligibility for government grant programs.

In summary, the definition of a small business is multifaceted, encompassing elements such as industry type, annual revenue, employee count, and legal structure.

This complexity mirrors the large number and diverse nature of US small businesses—and underscores their pivotal role in the economy.

Understand Why Circler.io is a Great Bookkeeping Tool for Small Businesses.

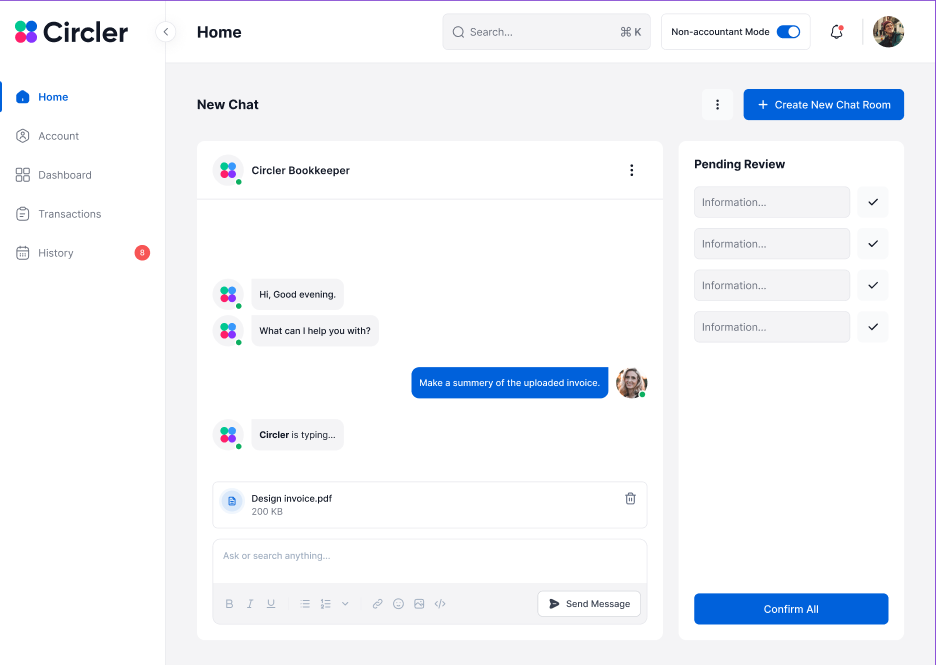

If you're planning to start a small business or already managing a team and seeking a more efficient bookkeeping solution, Circler.io is your go-to tool. It revolutionizes bookkeeping by simplifying the process: our AI listens to your instructions and effortlessly transforms complex receipts, bills, and invoices into accurately categorized journal entries. As an AI bookkeeping assistant, Circler.io not only saves on costs and time but also streamlines your bookkeeping with precision surpassing human capabilities.

With Circler.io, you're free to concentrate on what really matters - growing and expanding your business.

Join our "Product Hunt" to stay updated about our launch.