How to Track Your Rental Property Bookkeeping with Our Free Template

Managing rental property finances can be overwhelming, especially when it comes to tracking every penny of income. But it doesn’t have to be. Many rental property owners struggle to keep their income records organized and accurate, which is crucial for financial success and tax preparation. Our free rental property income tracking template is here to simplify the process, ensuring you have a clear and organized record of all your rental income.

- Why Tracking Rental Income is Crucial?

Importance: Accurate income tracking is vital for property owners for several reasons—tax compliance, financial analysis, and overall peace of mind. Without an organized system, it’s easy to miss out on income sources or make errors that could cost you time and money during tax season or when evaluating your financial health.

Common Pitfalls: It’s easy to forget to log all sources of income or to miscategorize them. These small errors can lead to bigger problems down the road, such as underreporting income or overpaying taxes. With accurate tracking, you can avoid these common pitfalls and maintain a clear picture of your financial status.

- Introducing Our Free Template

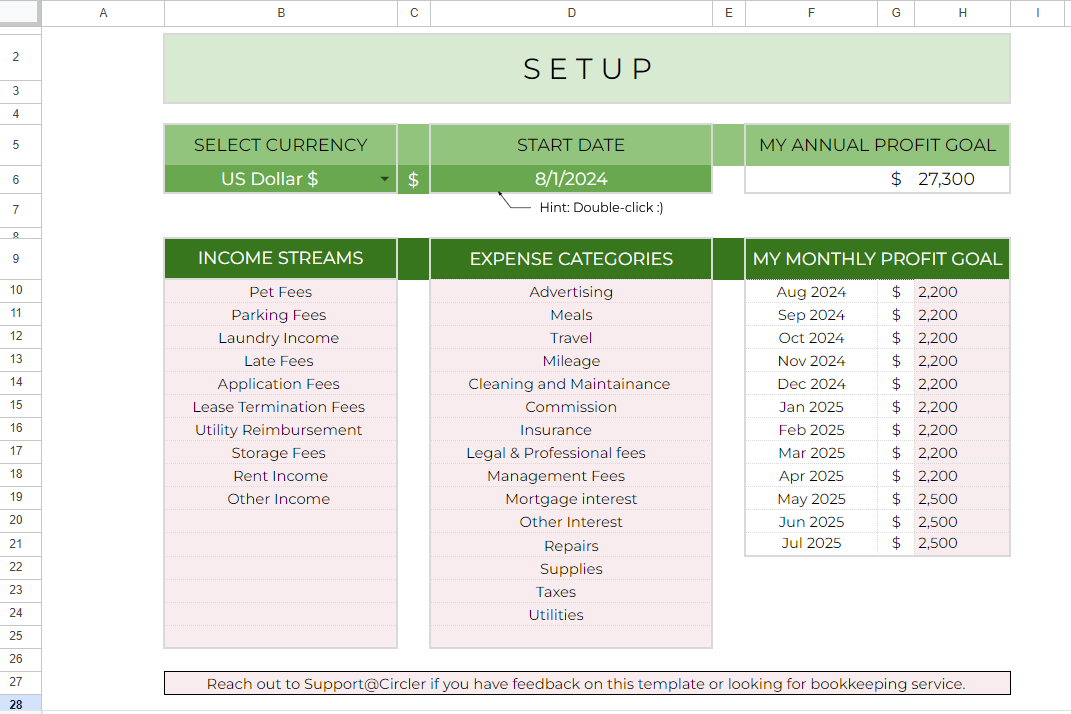

Overview: Our free rental property income tracking template is designed with simplicity and functionality in mind. It includes sections specifically for logging different types of rental income, categorizing it for easy tax reporting, and monitoring financial performance over time.

Template Benefits: Using this template makes it easier to stay organized, reduces errors, and saves time. By having all your income data in one place, you can easily access and review your records whenever needed. This streamlined approach also makes tax preparation a breeze, ensuring you don’t overlook any income sources.

- Step-by-Step Guide to Using the Template

Step 1: Download the Template Start by downloading the template. We’ve made it as easy as possible—just follow the download link and instructions to access it.

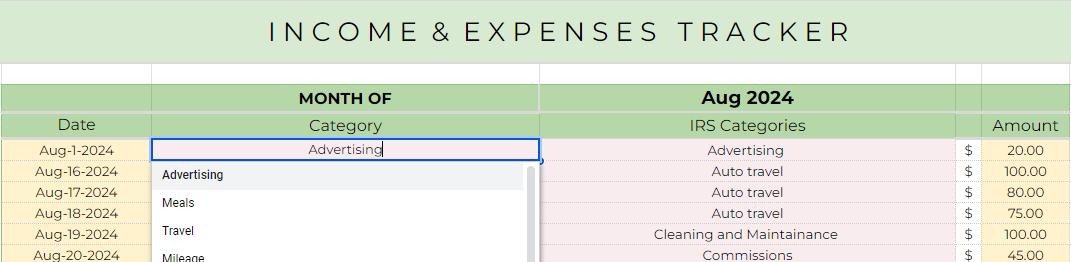

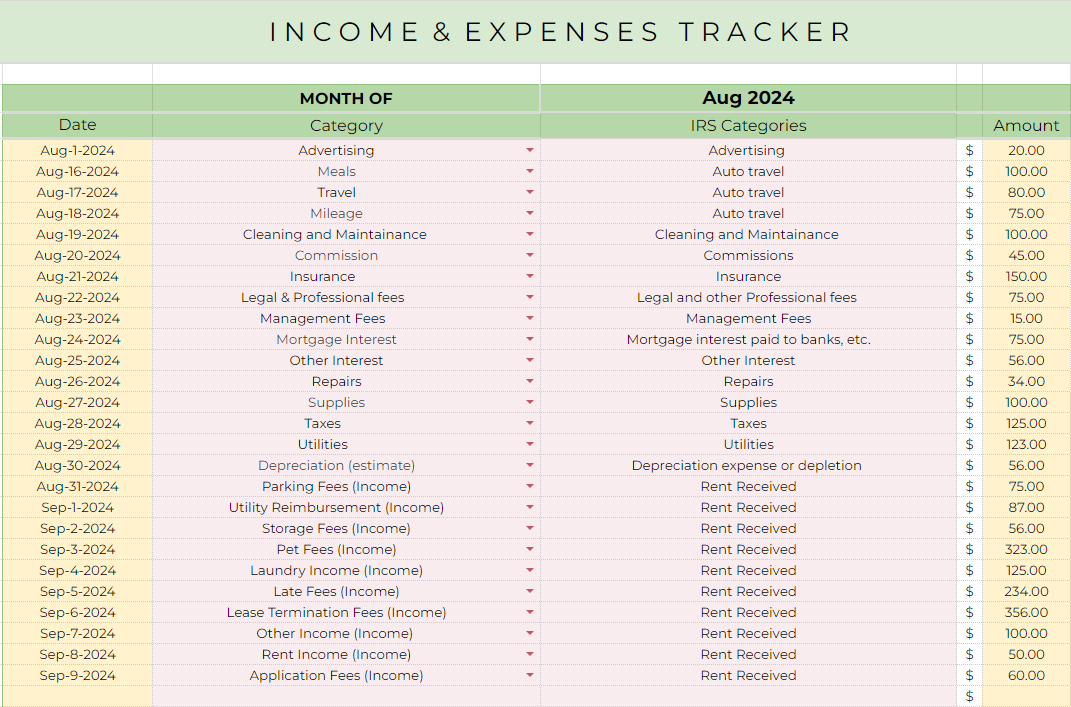

Step 2: Logging Income Entries To get started, enter your income data in the template. You can include different income sources like rent, late fees, and additional charges. Remember, timely logging is crucial to avoid missing any income.

Step 3: Categorizing Income

Next, categorize your income using IRS categories or custom categories relevant to your business. Choosing the right categories is important for accurate tax reporting, so take the time to review your options.

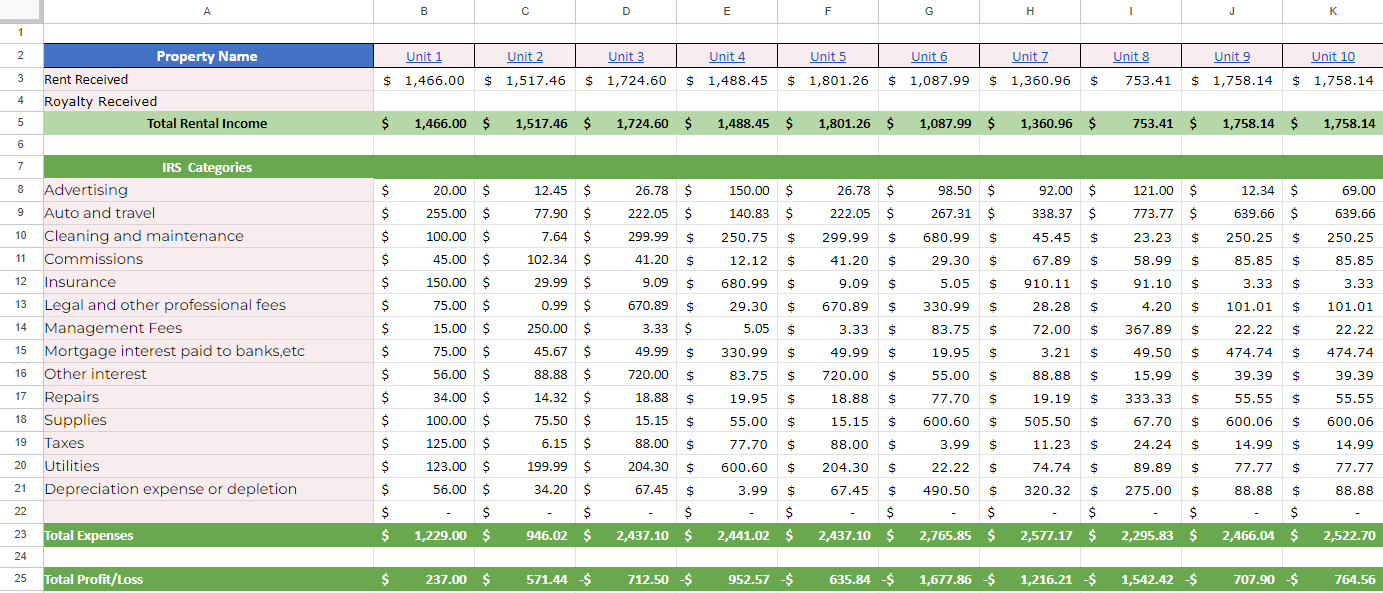

Step 4: Monitoring Financial Performance

Once your income data is entered and categorized, use the template to track your financial performance over time. Look for trends or issues in your income and expenses tracker, and review your records regularly to ensure everything looks accurate.

- How This Helps at Tax Time

Simplifies Tax Filing: When tax season rolls around, having all your income data organized in the template will make filing much easier. You’ll be able to quickly access the information you need, reducing stress and saving time.

Avoids Penalties: Accurate records are essential to avoid IRS penalties or audits. By keeping everything up-to-date in the template, you’ll have the documentation you need to support your tax filings.

- Real-World Example

Scenario: Let’s say you’re a rental property owner using this template to track your income throughout the year. As the months go by, you enter each payment received, categorize it correctly, and monitor your overall financial health.

Outcome: At the end of the year, you realize how much easier tax preparation has become. You’re able to confidently file your taxes, knowing that your records are accurate and complete. Plus, you’ve gained valuable insights into your rental income trends, helping you make better financial decisions for the future.

Tracking rental property income doesn’t have to be a daunting task. With our free template, you can easily organize your income records, stay on top of your finances, and simplify tax preparation. Ready to get started? Download the template today and take the first step toward a more organized rental business.

At Circler, we're excited to offer a FREE bookkeeping template specifically designed for rental property owners. Whether you're looking to streamline your bookkeeping, catch up on records, or start fresh with an organized system, this template is here to help. Download it today and simplify your financial management with ease. For any questions or support, feel free to reach out to us at support@circler.io. We're here to assist you in making your financial management stress-free.

If you found this information helpful and want to explore more, be sure to check out our blog on Top 5 Best Business Loans For Small Businesses in 2024. Click the title to learn about the important details and tips related to this crucial deadline.