How do profit and loss (P&L) statements work?

Wondering what a Profit and Loss (P&L) statement really tells you about a business?

Well, it's one of the three key financial statements companies regularly produce, providing a clear overview of Revenues, Expenses, and Net Profit over a specific period. Often called the Income Statement, the P&L is crucial for public companies to meet legal reporting requirements.

It's not just a formal document; market analysts, investors, and creditors closely examine P&L statements to assess a company's financial performance, including its revenue generation and expense management, ultimately reflecting its profitability.

This blog introduces you to the vital components and significance of P&L statements in the business world.

Table of Contents

Introduction

A profit and loss statement is a financial document that provides an overview of your business’s total income and total expenses in a set period.

Before we delve into the intriguing world of Profit and Loss (P&L) statements, let's take a moment to grasp some essential concepts you should be familiar with

- Foundation of P&L Statements: They can be prepared using either Cash-Based Accounting or Accrual-Based Accounting, each offering a different financial perspective.

- The Trio of Financial Reporting: Public companies are required to issue three key financial statements quarterly and annually – the P&L statement, the balance sheet, and the cash flow statement.

- A Comprehensive Financial Picture: Together, the P&L report, balance sheet, and cash flow statement form a 'triple threat', providing an all-encompassing view of a business's financial health and performance.

- Importance of Regular Review: Monitoring P&L statements across different accounting periods is crucial to identify trends and changes, going beyond just the surface numbers to understand the financial narrative of your business.

2. What Does a P&L Statement Show?

The P&L contains details about the company's revenue, or the total amount of income from the sale of goods or services associated with the company's primary operations. It also shows the company's business expenses, such as rent, cost of goods sold (COGS), freight, and payroll.

Expenses are deducted from revenue to provide the net income or net loss. A primary goal for any business is to achieve a net income, indicating financial health. If the net income is small compared to the revenue, it suggests the business is barely sustaining its operations, prompting a need to boost revenue or cut down costs

To calculate the net profit accurately, the P&L also factors in debts, interest payments, earnings from secondary activities or investments, and exceptional one-time costs like legal settlements.

Additionally, the statement includes vital subtotals, providing insights into aspects like long-term or short-term debt, raw material costs, overhead expenses, and tax liabilities.

The P&L Statement offers a full view of a company’s financial performance over a period, showing whether it has made a profit or incurred a loss. For accuracy in reflecting a company's profitability, accountants typically use accrual accounting. This method accounts for revenue and expenses at the time they occur, rather than when cash transactions happen.

3. Structure of the Profit and Loss Statement

The standard structure of a Profit and Loss (P&L) Statement typically includes several key components that provide a comprehensive view of a business's financial performance over a specific period.

Here's a brief overview of its structure:

- Total Revenue: This is the total income generated from the business's primary operations. It includes income from sales of goods or services and is the starting point of the income statement.

- Cost of Goods Sold (COGS): This represents the direct costs attributable to the production of the goods sold by a company. This includes the cost of the materials and labor directly used to create the product. It's subtracted from Total Revenue to determine Gross Profit.

- Gross Profit: Calculated as Total Revenue minus COGS, this figure shows the profitability of the company's core business activities before considering other operating expenses. It's a key indicator of the efficiency of the core business operations.

- Operating Expenses: These are the costs required to run the company that are not directly tied to the production of goods or services. This includes expenses like marketing, rent, utilities, administrative salaries, and depreciation. They are subtracted from Gross Profit to calculate Operating Income.

- Operating Income: Also known as Earnings Before Interest and Taxes (EBIT), this is calculated by subtracting Operating Expenses from Gross Profit.

- Other Income/Expenses: This includes any revenue or costs not related to the primary business activities, such as interest earned or expenses from loans.

- Net Income/Profit: The final line of the P&L Statement, is calculated by subtracting all expenses (including taxes) from total revenues. It represents the company's profit or loss during the reporting period.

This structure allows businesses and stakeholders to assess the financial health of the company, analyze its operational efficiency, and make informed decisions.

4. How to Prepare a Profit and Loss (P&L) Statement

Ready to prepare your P&L statement? You can do this in two ways: the single-step method or the multi-step method.

Sample of Profit and Loss (P&L) Statement for a hypothetical business, is formatted as a table

The single-step method

Are you a small business or operating in a service-based industry? Then this might be your method of choice. It calculates net income by subtracting expenses and losses from revenues and gains.

It gets its name from the fact that it uses a single subtotal for all revenue line items and a single subtotal for expense items. You can find your net gain or loss at the bottom of the statement, which is known as the “bottom line” in accounting.

| Item | Amount ($) |

|---|---|

| Sales Revenue | 150,000 |

| Service Revenue | 50,000 |

| Total Revenues | 200,000 |

| Cost of Goods Sold | 70,000 |

| Operating Expenses | 30,000 |

| Administrative Expenses | 20,000 |

| Total Expenses | 120,000 |

| Net Income | 80,000 |

This table represents a basic single-step Profit and Loss Statement. It lists all revenue sources followed by all expenses and calculates the net income by subtracting total expenses from total revenues

The multiple-step method

If you’re operating as a larger business and want a more in-depth look into your profits and financial operations, you’ll be more inclined to use the multi-step method, which—if you haven’t guessed—has a few more steps than the single-step method.

| Item | Amount ($) |

|---|---|

| Total Revenue | 1,000,000.00 |

| Less: Cost of Goods Sold | 378,700.00 |

| Gross Profit | 621,300.00 |

| Gross Profit Margin | 62.13 |

| Less: Expenses | |

| Accounting/Legal Fees | 15,500.00 |

| Advertising/Marketing | 27,000.00 |

| Depreciation | 14,000.00 |

| Utility Bills | 4,200.00 |

| Insurance | 20,200.00 |

| Interest/Finance Fees | 16,800.00 |

| Rent for Offices | 78,700.00 |

| Repairs/Maintenance | 15,400.00 |

| Wages/Salaries/Benefits | 201,500.00 |

| Other Expenses | 8,200.00 |

| Total Expenses | 401,500.00 |

| Net Profit | 219,800.00 |

| Net Profit Margin | 21.98 |

| Operating Expenses | 401,500.00 |

| Operating Income | 219,800.00 |

| Other Income/Expenses | 0 |

This table provides a clear overview of the company’s financial performance, using a multi-step method including total revenue, cost of goods sold, gross profit, expenses, and net profit. The percentages for gross profit margin and net profit margin offer additional insights into the company's profitability.

5. Do Small Businesses Need Profit and Loss Statements?

Absolutely. Profit and loss statements are not only crucial but occasionally mandatory. Publicly traded companies, for instance, are required to produce them. Small businesses seeking loans may also find that lenders request these statements. Additionally, they are often needed for tax purposes.

Now, focusing on their significance, P&L statements provide essential insights, such as the ones we'll explore below.

Where profit is coming from

If your business deals in a range of products or services, a Profit and Loss (P&L) statement allows you to categorize them into distinct line items. This categorization is invaluable in pinpointing which aspects of your business are yielding the most profit and which ones are underperforming. Understanding these distinctions is crucial for strategic business decision-making.

Evaluating Cost Management:

A Profit and Loss (P&L) statement acts as an objective tool to review your business's financial history. By comparing past quarters or years, you can conduct a thorough analysis of your financial performance. This comparison helps you assess if your expenses are rising at an expected rate, staying consistent, or perhaps increasing disproportionately compared to revenue growth.

For example, if your revenue grew by 10% over the previous year but your material costs soared by 40%, it's important to investigate the reasons and implications of such a change.

Assessing Profitability of Operations:

The true highlight of a P&L statement is its ability to show whether your business operations are profitable. The bottom line of the statement, quite literally at the end, reveals if your business is making a profit or incurring a loss. This clear indicator is essential for understanding the overall financial health of your business and guiding future financial strategies.

6. Utilizing P&L Statements for Informed Decision-Making and Strategic Planning

- Guiding Financial Decisions: Businesses leverage Profit and Loss (P&L) statements to make informed financial decisions. These statements provide a clear picture of the financial performance, including revenue streams, cost management, and overall profitability. By analyzing these factors, businesses can identify areas that need improvement, potential for cost-cutting, and opportunities for revenue growth.

- Strategic Planning and Forecasting: Regular analysis of P&L statements is crucial for strategic business planning. It allows companies to track financial trends over time, helping in forecasting future revenues and expenses. This ongoing analysis is vital for setting realistic budgets, planning for expansions, or making adjustments to business models.

By consistently reviewing P&L statements, businesses can ensure they are not only responding to their current financial situation but also proactively planning for future financial stability and growth.

7. Conclusion

In sum, the importance of Profit and Loss (P&L) statements in the business world cannot be overstated. They are crucial tools for evaluating financial performance, guiding decision-making, and informing strategic planning. Regular analysis of these statements allows businesses to gain a deep understanding of their financial health, identify areas for improvement, and plan for sustainable growth.

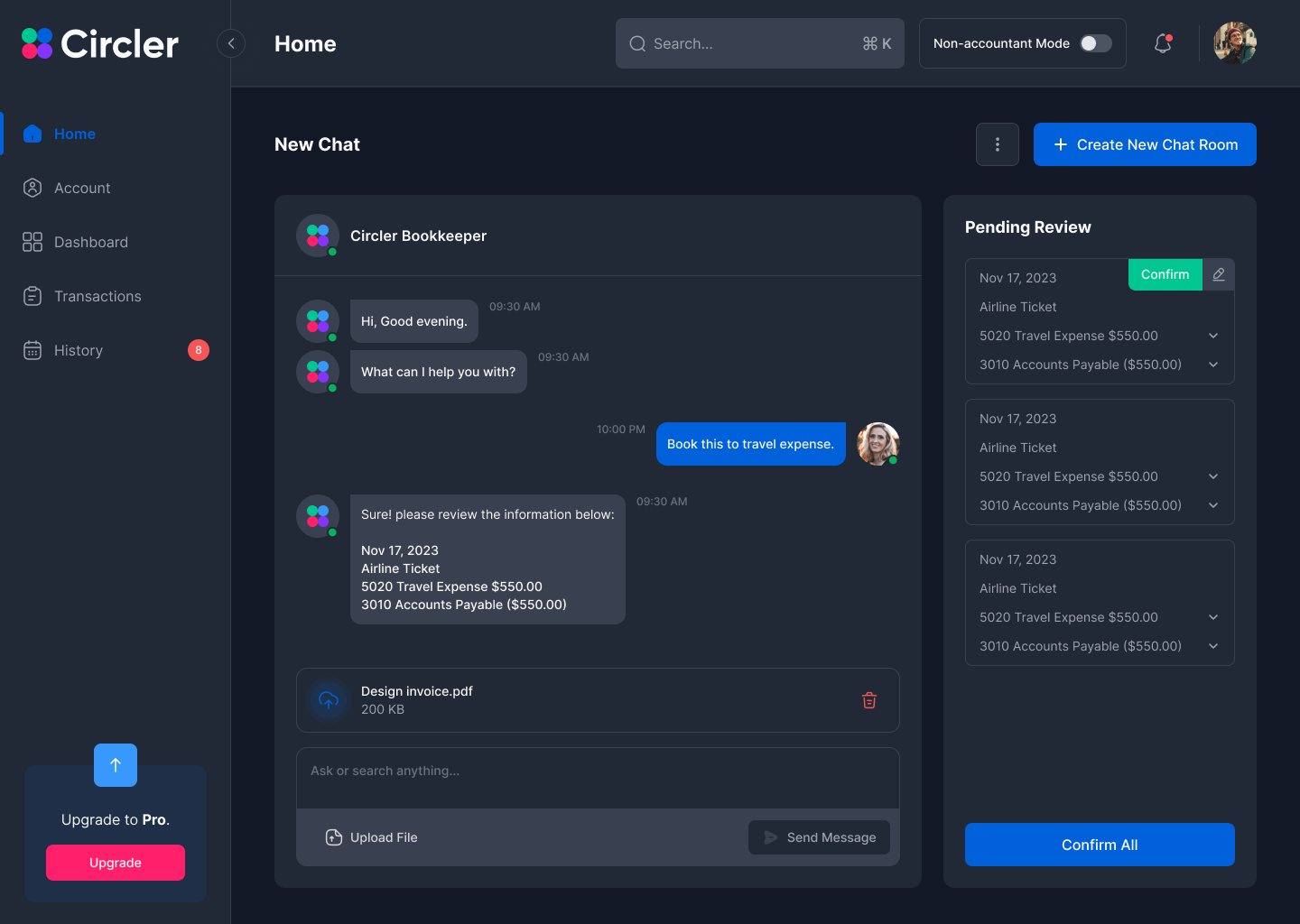

In this context, tools like Circler.io play a pivotal role. As an innovative bookkeeping assistant, Circler.io simplifies the process of recording transactions, making it easier for businesses to maintain accurate and up-to-date financial records. This is especially beneficial when it comes time to prepare and reconcile P&L statements. By automating the routine task of data entry and providing real-time financial insights, Circler.io not only saves time but also ensures that the information needed for effective P&L analysis is readily available and reliable.

Embracing Circler.io in your financial processes means that when it's time to analyze your P&L statement, you have a solid foundation of well-organized and accurately recorded financial data. This can lead to more insightful analyses and smarter financial decisions, ultimately contributing to the overall success and growth of your business.