Tax Day 2024: Did you miss the April 15 Deadline? Here’s everything you need to know:

As Tax Day 2024 has just passed, if you were unable to submit your 2023 tax returns by April 15, it's crucial to understand the implications and the next steps you can take

Consequences of Missing the Deadline:

1. Failure-to-File Penalty: If you don't file your tax return or an extension by the deadline, you're subject to a failure-to-file penalty. This penalty is usually 5% of the unpaid taxes for each month or part of a month that the tax return is late, up to a maximum of 25%

2. Failure-to-Pay Penalty: For unpaid taxes, the penalty is generally 0.5% per month, increasing to 1% if the tax remains unpaid ten days after the IRS issues a notice of intent to levy. The maximum penalty can also reach up to 25% of your unpaid taxes.

3. Interest: Interest is also charged on any unpaid taxes from the due date until the balance is paid in full, calculated at the federal short-term rate plus 3%

4. Larger Fees to be aware of: The penalty will continue to be charged until the tax is fully paid or until the maximum penalty of 25 percent is reached. In addition to the penalties, the IRS will start charging interest on any unpaid balance of taxes owed, which will accrue and compound daily from 15 April until the balance is paid in full.

The amount you may have to pay is calculated by how late you file your tax return and the amount of unpaid tax as of the original payment due date. Interest can also be changed on a penalty. Here's a breakdown of the math.

5. If You're Owed a Refund: There’s no penalty for filing late if you’re owed a refund. However, filing as soon as possible is crucial to receive your refund without delay. You have three years from the due date of the return to claim any refund due. After this period, unclaimed refunds become the property of the U.S. Treasury

6. How to File for an Extension:

You can request an automatic six-month extension to file your tax return using IRS Form 4868. This does not extend the time for paying taxes but allows more time to file your returns accurately.

How the IRS Calculates Penalties

The IRS calculates the "Failure to File" penalty based on the lateness of your tax return submission and the amount of unpaid tax by the original payment due date (excluding any extensions). Unpaid tax is defined as the total tax that should have been shown on your return, minus any amounts already covered by withholding, estimated tax payments, and allowable refundable credits.

More details on the Failure to File Penalty

- Monthly Penalty: The penalty is 5% of the unpaid taxes for each month or part of a month that the return is late, with a cap of 25% of your unpaid taxes.

- Interaction with Failure to Pay Penalty: If both "Failure to File" and "Failure to Pay" penalties are applicable in the same month, the "Failure to File" penalty is reduced by the "Failure to Pay" penalty amount for that month. This results in a combined monthly penalty of 5%.

- Duration of Penalties: The "Failure to File" penalty maxes out at 5 months. However, if taxes remain unpaid, the "Failure to Pay" penalty continues to accrue until the tax is fully paid, reaching up to 25% of the unpaid taxes as of the due date.

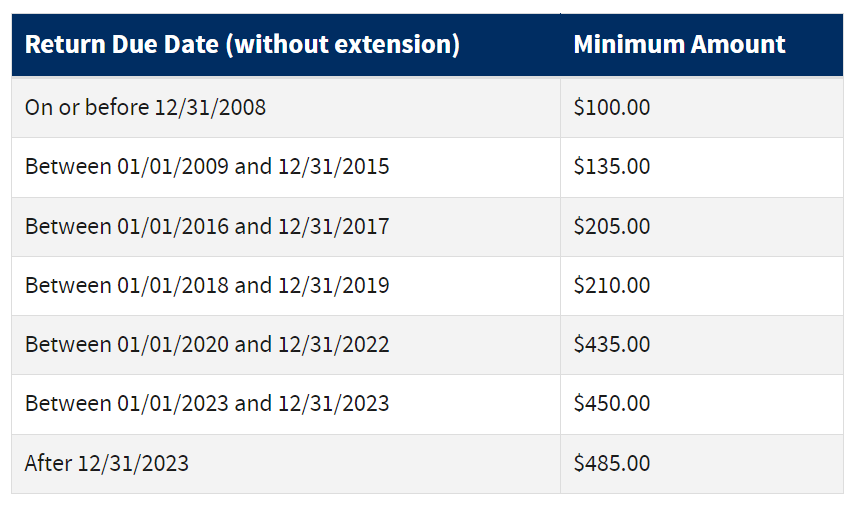

- Minimum Penalty for Extensive Delays: If the return is filed more than 60 days late, a minimum penalty applies, which is the lesser of the amounts specified below or 100% of the unpaid tax.

Note that penalties for missing state tax deadlines vary by state. It's important to check your state's specific rules and penalties for late filings.

Next Steps to Consider:

- File as soon as possible: Even without payment, filing reduces potential penalties.

- Explore payment plans: The IRS offers several payment options if you're facing financial difficulties.

- Claim your refund: Ensure you file within three years if you expect a refund.

At Circler, we are offering bookkeeping subscription at $175/month. Whether you need help to understand your accounts, streamlining your bookkeeping processes, catching up on your bookkeeping, or just start from scratch, don't hesitate to reach out to us at support@circler.io. We're here to assist you in making your financial management seamless and stress-free.