Top 5 Best Business Loans For Small Businesses in 2024

As a small business owner, obtaining a small business loan can provide the necessary funds for growth, regardless of whether you are a new entrepreneur or have been in business for a while. Understanding the many financing options for different businesses can be overwhelming.

To help you find the right loan, we've researched five types: lending marketplace, term loans, equipment loans, microloans, and SBA loans. We looked at loan amounts, repayment time and APR, credit score needed, and business requirements.

With so many lenders and loans available, it's important to simplify the decision-making process. We've put together a list of top small business loans to help you find the best partner for your business.

Before we dive into our top picks for small business loans, let's first address why these loans are fundamental to a business's success

1. Why get a small business loan?

There are several reasons to consider getting a small business loan:

- Start a business: For entrepreneurs just starting out, a small business loan can provide the necessary capital to cover initial expenses and establish the venture.

- Expand operations: Existing businesses can use a small business loan to fund expansion plans, such as opening new locations or acquiring additional businesses.

- Buy or upgrade equipment: Small business loans are often used to purchase or upgrade essential equipment that is crucial for business operations.

- Access working capital: A small business loan or line of credit can provide working capital to manage cash flow and cover day-to-day business expenses, including inventory and accounts payable.

- Refinance business debt: Small business loans can be used to refinance existing business debt, especially if it is at a high-interest rate, in order to secure more affordable terms

2. What are the Types of Small Business Loans?

There are various types of small business loans available for both startups and established businesses. Initially, the decision to be made is whether to opt for an SBA loan or a non-SBA small business loan, which are sometimes incorrectly used interchangeably.

An SBA loan is a small business loan backed by the Small Business Administration, allowing lenders to offer it to more business owners at competitive rates.

However, there are numerous small business funding options that are not SBA loans. Some examples include:

- Term loan: This is an installment loan with a fixed interest rate and repayment term, suitable for large purchases and growth opportunities.

- Business line of credit: A business line of credit provides a flexible source of funds, similar to a credit card. Businesses can use it as needed for cash flow management or to fund ongoing projects. It's a revolving fund, meaning you can borrow, repay, and borrow again up to your credit limit

- Commercial real estate loan: A commercial real estate loan is used by businesses to buy property, like offices or retail spaces. Similar to a home mortgage, this loan is backed by the property itself, serving as collateral.

- Microloan: Typically for $50,000 or less, this term loan is designed for very small businesses in need of a small amount of funding.

- Franchise loan: A franchise loan is designed for those looking to open a franchise. This type of loan, offered by many lenders, can include options backed by the SBA, specifically tailored for franchise financing

- Invoice factoring: Invoice factoring is when you sell your unpaid invoices (accounts receivable) to a lender in exchange for immediate cash. You receive the money upfront, while the lender takes over collecting from your invoices.

- Invoice financing: Allows businesses to use accounts receivable as collateral for a loan, without outright selling the invoices.

- Equipment financing: Designed for businesses planning to purchase equipment, covering a wide range of equipment types and price points.

- Merchant cash advance: Similar to invoice financing, A merchant cash advance gives you funding based on your future sales. You get a lump sum upfront, and then you make regular payments, often daily, based on a percentage of your sales.

- Personal loans for business: A personal loan isn’t a business loan at all. Instead, a business owner might take out a personal loan in their own name and use the proceeds to fund their business expenses. Keep in mind that many personal loan lenders prohibit this practice.

- Business credit cards: A business credit card could be an ideal solution for managing your cash flow. This type of card offers a revolving line of credit, allowing you to repeatedly use and pay off the balance for your business expenses. You may even be able to earn rewards for your business spending

3. Pros and cons of small business loans

| Pros | Cons |

|---|---|

| Can accelerate business growth by providing essential capital | Not always available to startups due to lack of credit history or revenue |

| May be available at affordable interest rates, making them cost-effective | The application process can be time-consuming and require extensive documentation |

| Offers flexible funding and usage, catering to various business needs. | May require personal guarantees, collateral, or down payments, adding risk |

| Can help in building and improving business credit scores | Navigating through various loan types and fees can be overwhelming and confusing |

| Interest paid on loans is often tax-deductible, providing financial relief. | Creates a debt obligation that can strain finances if not managed properly |

Small business loans offer numerous advantages for entrepreneurs aiming to launch or expand a business. These loans can significantly expedite business growth, potentially shaving off years compared to relying solely on existing cash flow for expansion.

Furthermore, a wide array of business loans, as mentioned earlier, cater to a multitude of business needs, providing crucial flexibility during the pivotal growth phases.

However, it's important to note that small business loans come with certain drawbacks. The application process is often more rigorous than that of personal loans, requiring demonstration of a specific duration of business operation, meeting predefined business or sales revenue benchmarks, and potentially necessitating a personal guarantee on behalf of the business

4. Requirements to qualify for a small business loan

Qualifying for a small business loan involves meeting specific criteria set by the lender. While these requirements can vary, there are common factors you can anticipate when seeking a loan

- Credit scores: Lenders may review your credit score and history as well as the business credit score to assess risk and see how credit was previously managed. You’ll likely need a personal credit score of at least 600, but a good credit score of 670 or higher will help you qualify for better interest rates. (as per Forbes)

- Gross revenue: Traditional lenders like banks typically require a minimum annual revenue of $100,000, but alternative lenders may offer funding for revenues as low as $33,000 to $50,000 per year. (Quoted by Bankrate)

- Years in business: Many lenders mandate a minimum business operation duration, commonly around six months, Traditional banks often require you to be in business for at least two years

- Personal financial history: lenders carefully review your business's financial statements, including income statements, balance sheets, and cash flow statements, when assessing loan eligibility. Using Circler.io can help you keep your books organized, making reconciliation easier.

- Industry type: Certain lenders may specialize in specific industries or have limitations on the industries they work with. For example, you may have a harder time getting a loan in industries like cannabis, cryptocurrency, adult entertainment, and gambling.

- Business plan: Some lenders may request a comprehensive business plan outlining projected revenues and income sources.

- Loan proposal: It’s a pitch that tells the lender how you’ll use the funding, how it will benefit your business, and how you’ll repay the debt. Though not all lenders require a loan proposal, some may.

- Down payment: Certain business loans, particularly those for asset purchases like equipment or real estate, may necessitate a down payment.

- Collateral: Secured business loans often require collateral, such as a financial account or physical asset.

- Personal guarantee: This assures the lender that, if the business defaults on the loan, the owner will assume responsibility for repayment.

- Debt-to-income (DTI) ratios: Your debt-to-income ratio (DTI) is all your monthly debt payments divided by your gross monthly income. This number is one-way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow.

5. Top 5 Best Small Business Loans: Our Pick!

1. SmartBiz - (Lending Marketplace for loans)

Key Features:

- Annual percentage rate (APR): Starting at 6.99% (11.25% for SBA loans)*

- Loan Amount: $30,000 to $500,000

- Minimum credit score: 650 (SBA)

- Best For: Best for SBA loans

SmartBiz operates as a lending marketplace rather than a direct lender. It assists in matching small business loan applicants with lending options that align with their needs. While SmartBiz facilitates various loan types, it is particularly well-suited for Small Business Administration (SBA) loans. The platform claims to be a leading facilitator of SBA loans under $500,000 in terms of volume.s

However, there are some drawbacks to using SmartBiz. As it is not a direct lender, it cannot guarantee the specific loan product you will receive. While you may have a positive experience with SmartBiz, your experience with the direct lender may differ. Additionally, SmartBiz has stringent eligibility requirements, mandating at least fair credit and two years of business operation to qualify for a loan.

| Pros | Cons |

|---|---|

| Leading facilitator of SBA loans below $500,000 | Requires two years in business |

| Multiple loan types to choose from | Not a direct lender |

| High loan amounts | Requires fair credit |

2. Biz2Credit - (Term Loan / Flexible financing)

Key Features:

- Annual percentage rate (APR): Starting at 4%*

- Loan Amount: $5,000 to $2 million

- Minimum credit score: 575 (working capital), 660 (term loan)

- Best For: Best for flexible loan options (Small Business Loans · SBA Loan · Business Line of Credit · Equipment Financing · Merchant Cash Advance · Unsecured Business Loan)

Biz2Credit provides a range of flexible loan options, including working capital and term loans. For working capital, the qualification criteria are relatively accessible, requiring only six months in business and a credit score of 575.

Borrowers can access up to $2 million in working capital or $500,000 in term loan funds. Moreover, both loan types offer multiple repayment options, such as daily, weekly, bimonthly, and monthly.

However, the requirements for a term loan are more stringent, necessitating a minimum of 18 months in business and a credit score of at least 660. Additionally, both loan types mandate high business revenue of at least $250,000. It is important to note that the starting interest rates on term loans from Biz2Credit are relatively high compared to competitors, starting at 15.99% and above, which may result in higher overall loan costs.

| Pros | Cons |

|---|---|

| Flexible repayment options | High revenue requirement |

| Large loan amounts | Requires 18 months in business for a term loan |

| Low credit score requirement | High minimum APR on term loans |

3. Credibly - (Flexible financing)

Key Features:

- Annual percentage rate (APR): Factor rates starting at 1.11*

- Loan Amount: $5,000 to $400,000

- Minimum credit score: 500

- Best For: Best small business loan, SBA, Merchant Cash, Line of credit.

Credibly provides a variety of loan options suitable for different business needs, including flexible loan amounts and accessible credit score thresholds. Their offerings cover SBA loans, working capital loans, merchant cash advances, and more.

By inputting some details on their website, you can pre-qualify for a loan quickly. If you proceed with the formal application, you might receive your loan funds on the same day.

However, there are some aspects to be mindful of with Credibly. They require your business to have at least six months of operation and a minimum of $180,000 in yearly sales. Their repayment periods tend to be on the shorter side, typically 18 to 24 months, and there may be additional fees, such as origination, underwriting, and monthly service charges

| Pros | Cons |

|---|---|

| Many business loan types | Repayment terms capped at (12 - 24 months) |

| Low minimum credit score of over 500 | Charges origination, underwriting and monthly fees |

| Pre-qualification with no credit impact | Requires six months in business |

| Same-day funding | High revenue requirement |

4. Accion Opportunity Fund (microloans)

Key Features:

- Annual percentage rate (APR): Starting at 7.49% to 24.99%*

- Loan Amount: $5,000 to $250,000

- Minimum credit score: 575

- Best For: Best for women and minority business owners

The Accion Opportunity Fund is a valuable option for small business loans, particularly for women-owned or minority-owned businesses, as well as those looking to support such enterprises. Notably, 90% of Accion's loans are directed to borrowers who identify as women, people of color, or individuals with low income. Moreover, as a nonprofit organization with a distinctive lending model, Accion reinvests the funds repaid on loans into other small businesses.

Accion offers a range of repayment terms, spanning 1, 2, 3, or 5 years, and provides unique benefits such as business advising services, particularly beneficial for less-experienced business owners.

However, Accion may not be suitable for everyone, as it does not extend loans to businesses in Montana, North Dakota, South Dakota, Tennessee, or Vermont. Furthermore, the organization's loan types are not as diverse as those offered by most lenders, and its eligibility requirements are not publicly disclosed, necessitating the completion of an application to determine qualification

| Pros | Cons |

|---|---|

| Serves Small, minority businesses | minimum Information on eligibility requirements |

| No prepayment penalty | Doesn’t offer business lines of credit — term loans only |

| Customized loans and repayment schedules | Not available in all states |

| Provides educational resources, coaching and support | High minimum loan amounts (Minimum funding in some states starts at $10,000 to $15,000, while others go even higher.) |

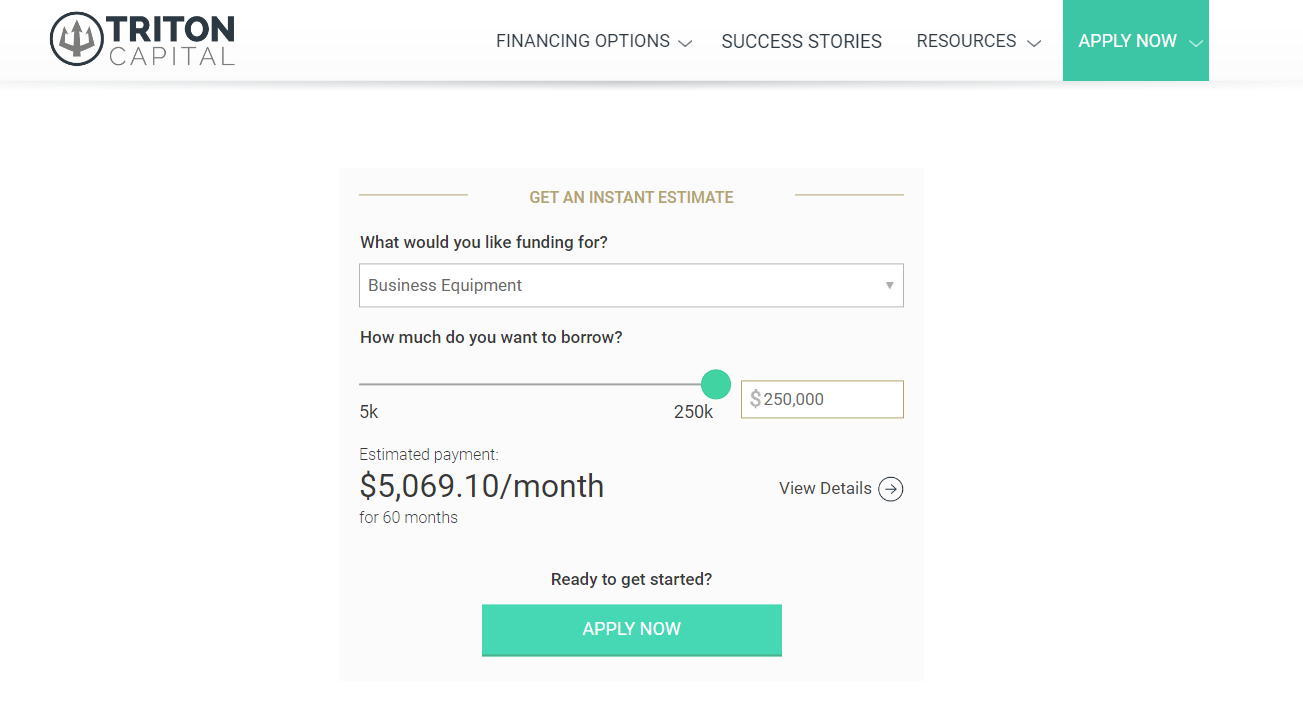

5. Triton Capital - (Equipment loan)

Key Features:

- Annual percentage rate (APR): Starting at 5.99%*

- Loan Amount: $5,000 to $250,000

- Minimum credit score: 600

- Best For: Best for equipment financing

Triton Capital, a loan marketplace headquartered in San Diego, specializes in providing instant funding, with the potential for funds to be disbursed in as little as two days. The company primarily focuses on offering fast equipment loans of up to $250,000 to businesses across various industries.

While Triton Capital also provides Small Business Administration (SBA) loans and other financing options, it is particularly recognized as a top small business lender for equipment financing. Borrowers have the flexibility to secure up to $250,000 for any type of equipment and can repay the loan over a period of one to five years. Additionally, Triton Capital stands out by offering multiple payment frequency options, including monthly, quarterly, seasonally, semi-annually, or annually. The loan approval process is typically swift, with loans often being approved within hours and funds potentially reaching the borrower's bank account as soon as the next business day.

However, despite its numerous advantages, Triton Capital has some drawbacks. The company's website lacks transparency, making it challenging for potential borrowers to access information about loan fees, maximum interest rates, or eligibility requirements without completing the preapproval process.

| Pros | Cons |

|---|---|

| Multiple loan types | Doesn’t disclose maximum APR |

| Financing for any equipment type | Requires a personal guarantee |

| Low minimum APR | High required annual revenue |

Conclusion

In 2024, the world of business loans is rich with options, especially for startups and small businesses looking to raise capital without sacrificing equity. When you're applying for a loan, having all your financial documents in order is super important. This is where Circler.io can really help.

Circler.io is a great asset in this regard. It's a user-friendly tool that simplifies bookkeeping, with a dashboard that makes it easy to navigate and organize your financial records, including receipts, journal entries, and bills. It's akin to having a personal assistant dedicated to managing your business finances.

Remember to check with your lender about what documents you need to apply for a loan. These might be things like your tax returns, financial records, or even financial projections if you’re just starting out. Once you pick a lender and a loan, just fill in the application and send it with all the documents they ask for. Some lenders might get back to you the same day, but others might take a bit longer.

In short, choosing the right loan can really help your business grow, and being organized with your finances is a big part of making the loan process smooth. With Circler.io in your corner, getting all your financial documents ready for your loan application becomes a whole lot easier.